So you’ve dropped your precious phone and destroyed it in one way or another, and getting it fixed will cost you quite a bit of money. At times, getting it fixed just doesn’t feel worth the money especially if it is an old model, but at the same time, you can’t fork out a lump sum for a cool new phone. Well, there is a way to walk away with a new iPhone thanks to U Mobile’s Flexi U Microcredit.

Catered Just For You

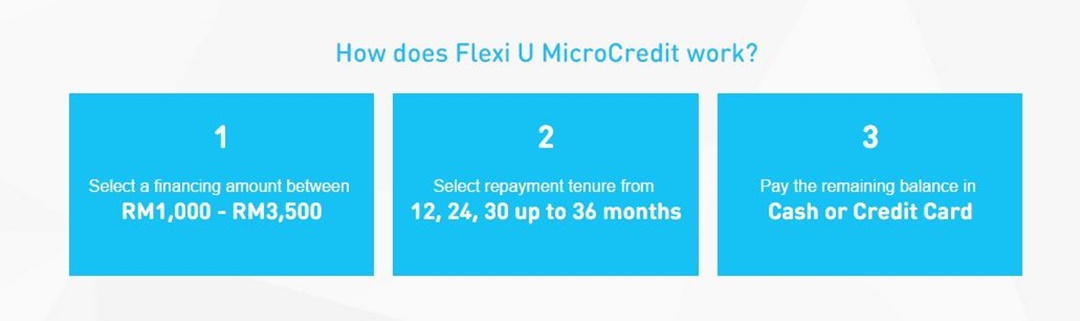

In a nutshell, U Microcredit is a loan to own a phone of your choice. However, unlike other loans, you don’t need to put down any deposit, collateral or own a credit card. It is called Flexi for a reason, as you are able to choose how much loan you want to apply for, select the most comfortable repayment period, and pay the remaining balance in cash or credit card if there is any. You can even decide to take a full loan with the longest repayment period of 36 months should you feel that would suit your budget better. In addition, you can choose to go with a prepaid or postpaid plan with U Microcredit.

Flexible Budget Choices

The next part is to plan your repayment budget. Let’s take the new iPhone 6S. Traditionally, owning the latest iPhone would mean having to save up for a long, long time, to the point where you will probably only able to afford it once it has become an old model. However, with U Microcredit, you can take an iPhone home as soon as you sign up and pay a minimal amount.

When it comes to budgeting, you just need to do four things. First, decide on your favorite iPhone model of choice. Secondly, select a loan amount between RM1,000 to the full price of the subsidized iPhone. Then, decide how long a loan you want to take. You can choose four different repayment period: 12 months, 24 months, 30 months or 36 months. Lastly, you need to select an iPlan of your choice.

Installment Simplified

Doing complicated math may not be your cup of tea, but let’s help simplify the calculation for you. Let’s take the latest iPhone 6S as an example. The subsidized amount is at RM2925.60 for an instalment plan. Say you’ve saved enough but short of that RM1000, so you take that loan amount. With a 1.2% interest monthly for that loan, you just need to pay RM48 every month for the next 36 months for your phone, and RM31.80 for an i40 plan. Didn’t save at all? You can just take a full loan for that phone, and you will just need to pay RM114 monthly for the phone, and a fee of RM31.80 for the i40 plan. Compared to paying RM2925.60 at a go for the phone, paying monthly is still much easier to the wallet.

If you don’t want to do too much calculation, just head to U Mobile U Microcredit Instalment Calculator to check out how much you need to pay for the iPhone of your dreams.

http://www.u.com.my/umicrocredit