Counterpoint Research, the Hong Kong based global analysis firm, recently released a press release concerning the shipment of smartphones in the South East Asian market in 2022.

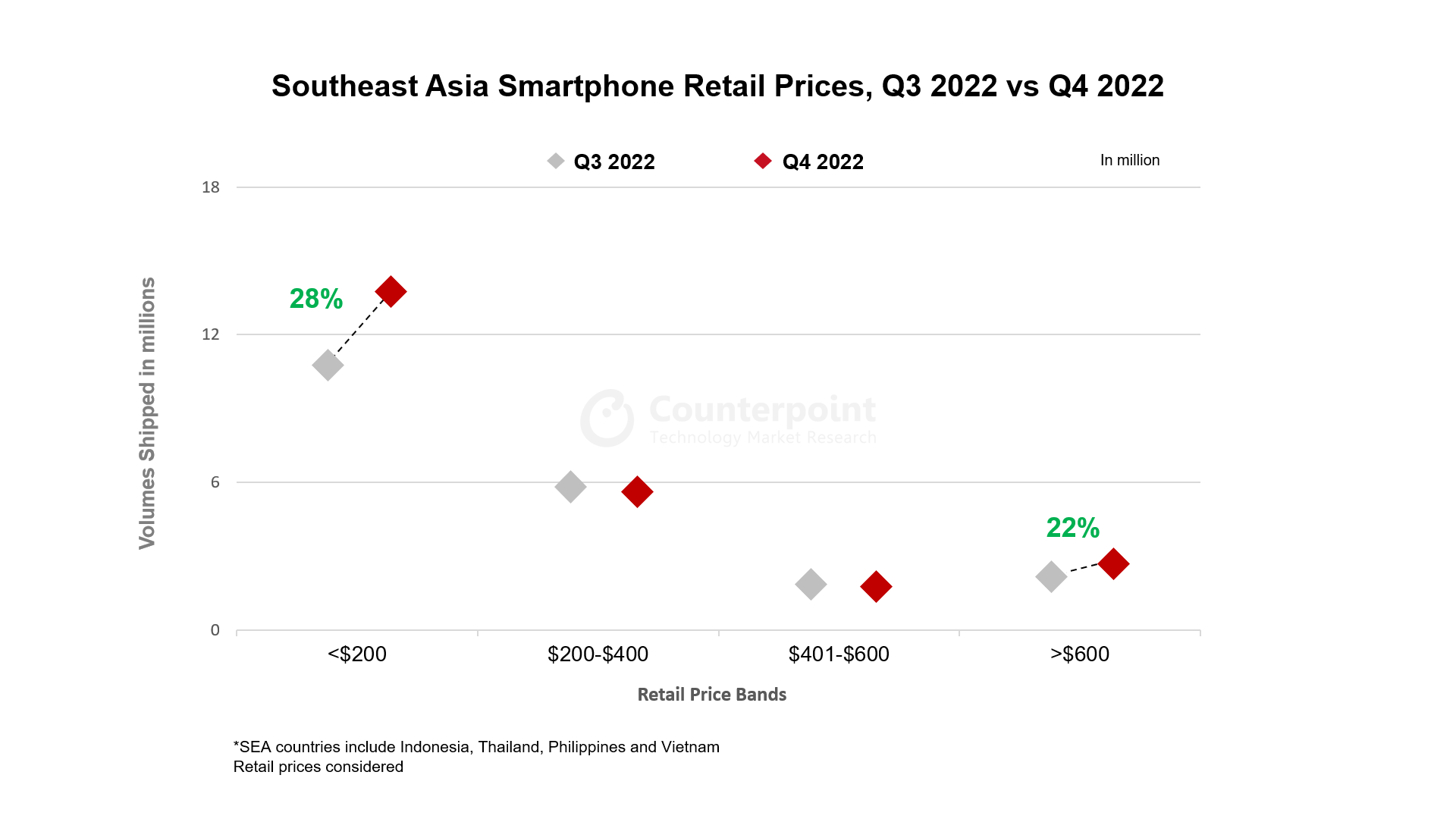

The article, titled Entry-level Smartphone Shipments Bounce Back in Key SEA Countries, Up 28% QoQ in Q4 2022, contained a multitude of interesting information.

The Rise of the Entry-Level Smartphones?

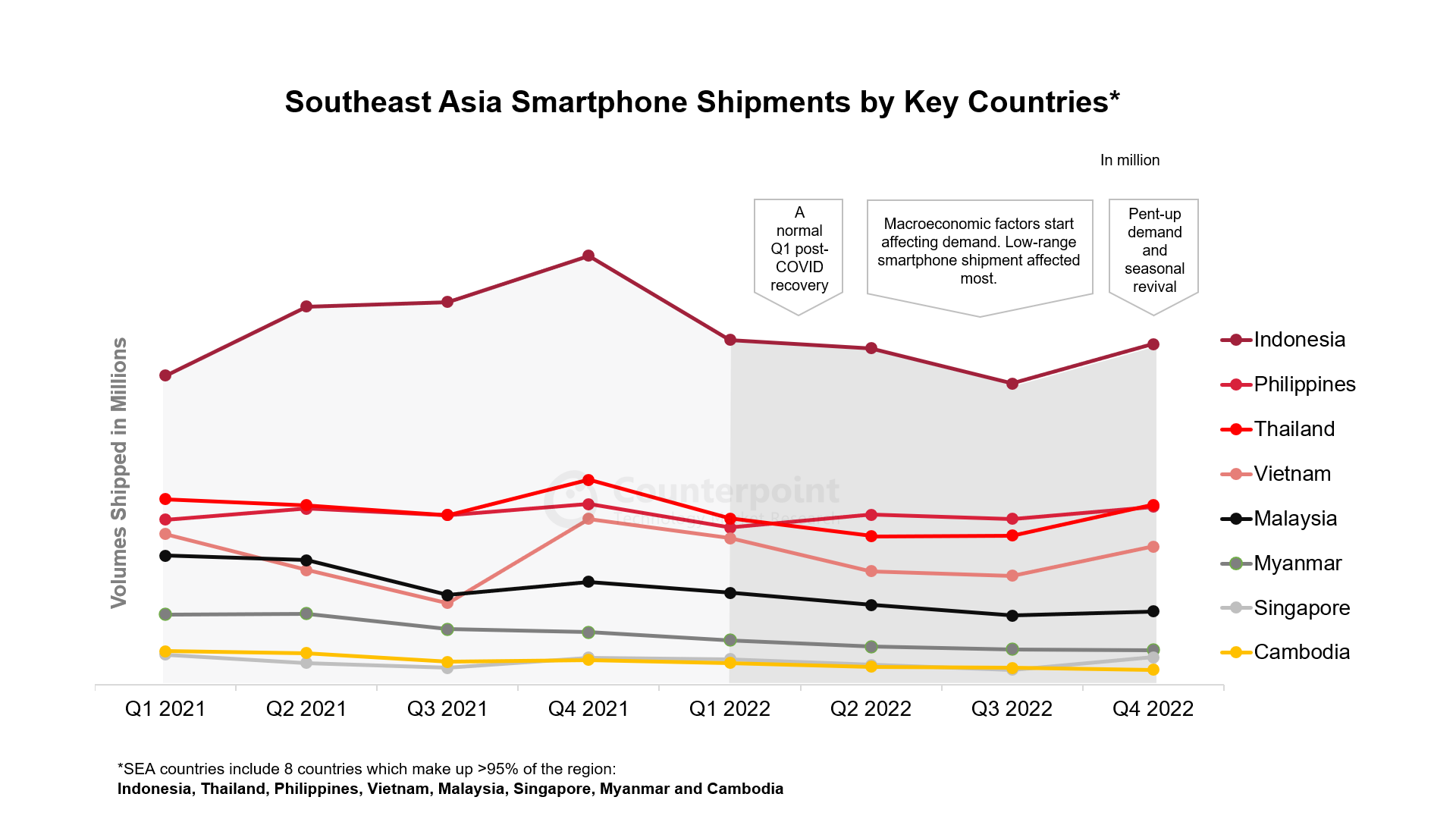

2022 saw an overall drop in the shipment of smartphones to the SEA countries, with 13% less shipments compared to last year.

While mid-tier smartphones (priced $200-$400) and high-end smartphones ($401-$600) saw a slight decline in shipment from Q3 to Q4, there was an upward trend towards the shipment of budget smartphones (priced less than $200) and premium smartphones (priced more than $600) by the end of the year, with each smartphone price category gaining 28% and 22% over their previous quarters respectively. Could this suggest the rising popularity of budget smartphones, as well as premium smartphones?

Malaysian Smartphone Shipments

Regarding Malaysia in 2022, data shows that the country suffered a steady, but not steep, decline in smartphone shipments Q1 to Q3, before slightly rising in Q4 2022. Malaysia was also said to be one of the small markets of SEA, alongside Myanmar and Cambodia, to be the most affected in declining smartphone demand. This was most likely due to the countries’ high share of economically disadvantaged citizens, the ones who were the most affected by the declining overall smartphone shipments of 2022, especially that of the entry-level smartphones.

Chinese Brands in Trouble?

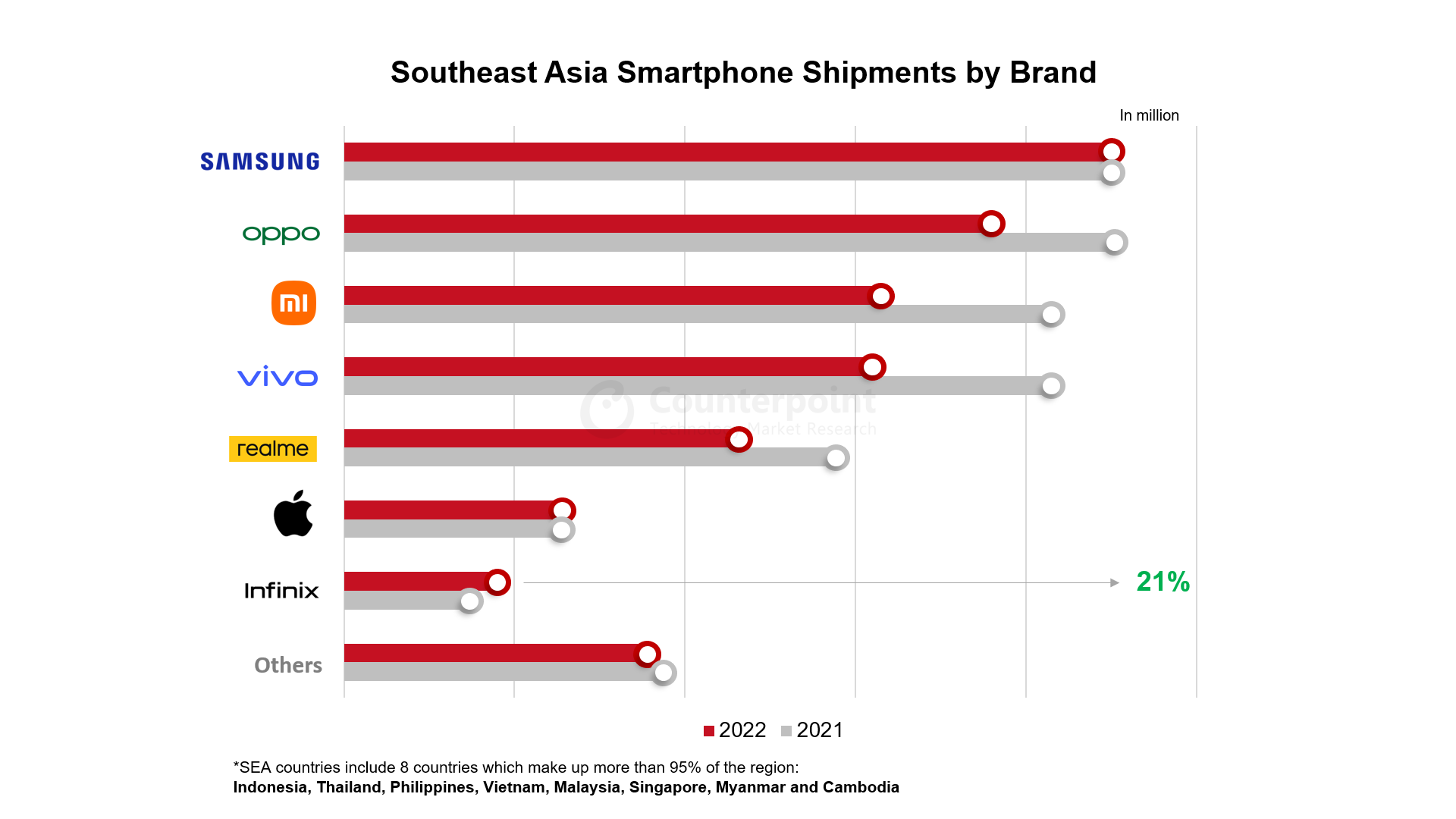

In 2022, Chinese smartphone brands such as vivo, Realme, and Xiaomi all suffered from overwhelming consumer demand and underwhelming inventory and stock. Amidst the group, OPPO was the only brand who was able to meet their consumer’s demand expectations.

However, all of the brands mentioned above suffered in smartphone shipments throughout 2022, posting lower numbers compared to their previous year. Amongst the most popular smartphone brands, only two remained relatively undisturbed, that being Samsung and Apple, who posted similar numbers to their previous year’s shipments.

The report also mentioned how companies looking to diversify their production might impact China’s economy, as more and more smartphone brands are building manufacturing plants in SEA countries such as Vietnam.

A Challenger Arrives

In this year of declining smartphone shipments, however, one brand managed to rise above the rest, posting a positive increase in shipments compared to the other brands’ declining shipments. Infinix was said to have made 21% more smartphone shipments compared to last year, an impressive feat considering the overall downward trend this year had. Infinix’s focus on budget oriented devices might have helped propel them forward, especially considering the popularity of entry-level smartphones towards the end of 2022.

Overall, it can be seen from the data that entry level smartphones are on the rise, Chinese brands aren’t fulfilling their demands, and Infinix could be a real contender in the future of smartphone brands.

Get real time update about this post category directly on your device, subscribe now.