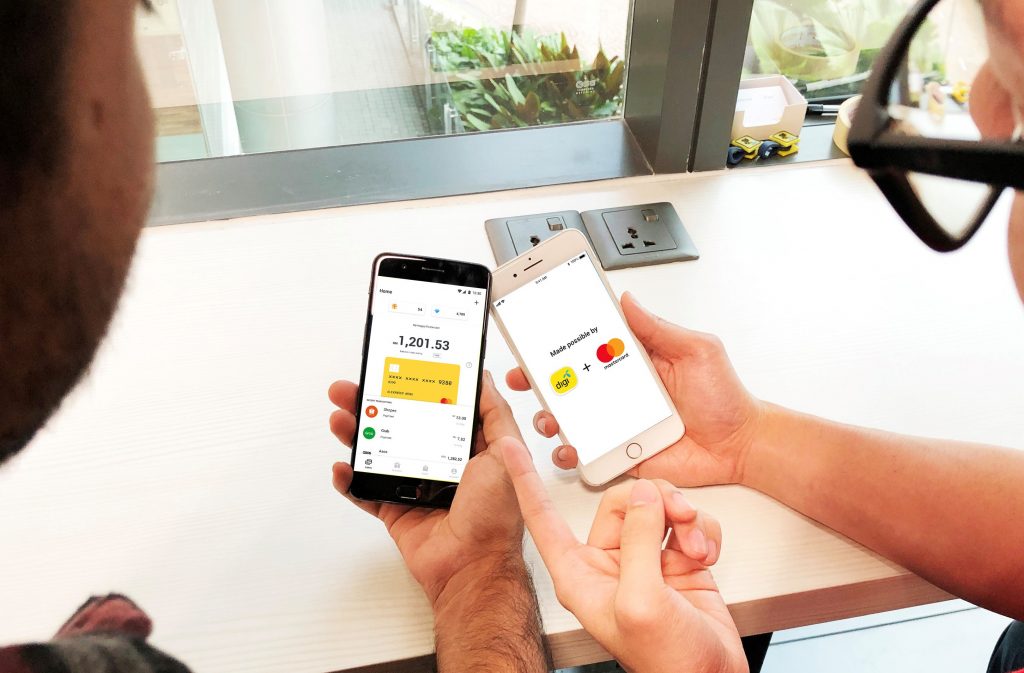

Digi has announced its partnership with ManagePay Systems Berhad (MPay) and MasterCard as supporting payment technology partners, to offer a new payment proposition to meet the fast-evolving needs of Malaysia’s growing online community.

The partnership has worked together on the development of a digital prepaid card, which will be made available for the public in the first half of the year.

This digital prepaid card enables young Malaysians access digital payments online and in-app across merchant locations that accepts MasterCard worldwide.

The card is specially designed for those who prefer to use online transactions when making a purchase.

Customers can sign up, activate and use the card all within a single mobile app as

part of a simple, safe and secure end-to-end digital experience.

Praveen Rajan, Digi’s Chief Digital Officer said, “We have observed that the majority of e-commerce transactions still occur with cash. We want to play our part in assisting people to go cashless, and more importantly, offer them the convenience to do what they want on their devices. This partnership with MPay and Mastercard will give young Malaysians a new option to pay and purchase anywhere globally.”

“Our focus will be to acquire retailers and e-tailers to provide them the ability to accept digital card payments and unlock the benefits of going cashless. This includes having access to a suite of merchant tools for improved customer retention, which will

translate into a more engaging and efficient in-app cashless experience for card holders,” said Dato’ Chew Chee Seng, MPay Group’s Founder, Managing Director and CEO.

Based on MasterCard’s latest online shopping survey, the amount of Malaysians embracing online shopping has increased with 89% having made at least one purchase towards year end 2017, compared to 81% in 2015.

Perry Ong, Country Manager, Malaysia and Brunei, Mastercard said, “The ease and convenience of online shopping, combined with the security and flexibility of this new prepaid proposition, is timely to address the fast-paced needs of young, on-the-go Malaysians. As Malaysia moves towards a cashless society, it is essential to also meet the needs of the unbanked segment of the population. Mastercard is pleased to embark on this partnership as it reinforces a shared effort to not only further expand the digital payments footprint in Malaysia’s growing e-commerce space but also encourage financial inclusion for those outside the mainstream digital banking system.”