If you’ve been keeping up with all the latest Apple announcements for the past day, you’d know that the fruit company’s newest offerings don’t stray far from what the company does – consumer tech. The most far-fetched announcement came by way of Apple Arcade – their very own gaming subscription service.

It seems like Apple isn’t just a company that makes phones, computers and operating systems – they’re also dipping their toes into the finance and e-wallet market by introducing Apple Card.

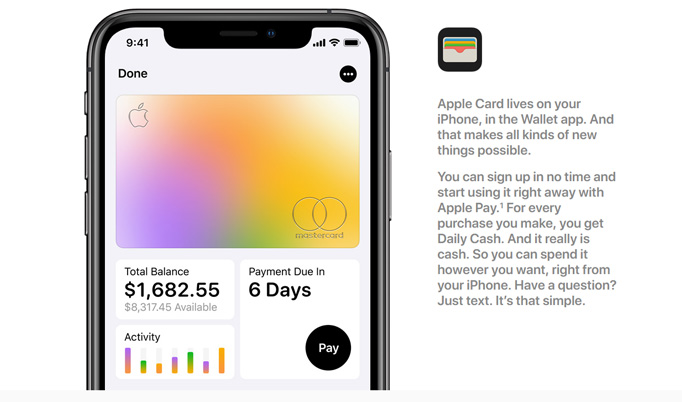

Image credit: Apple

Developed in partnership with Goldman Sachs and MasterCard, Apple Card is basically a credit card that can be used like any other credit card; but one benefit is that it can be stored digitally on Apple’s Wallet app so all banking details such as statements, balance and payment due dates can be viewed in your Apple device.

The card doesn’t have a CVV, signature or expiration date like a traditional credit card, but it generates security codes for e-shopping purposes. However, this only works for websites that support Apple Card; otherwise, you’ll have to provide your 16-digit card number.

If you’re planning to use the card to make physical purchases, you should be able to do so at any store that accepts MasterCard.

Get real time update about this post category directly on your device, subscribe now.